Understanding Insurer Takebacks: What Physicians Need to Know

Insurance takebacks, or recoupments, occur when an insurance company requests a refund for payments previously made to healthcare providers. These requests can be initiated for several reasons, such as:

- Duplicate Payments: The insurer realizes they have paid the same claim more than once.

- Coverage Termination: The patient’s insurance coverage was not active at the time of service.

- Overpayments: The insurer believes they paid more than the agreed amount for a specific service or procedure.

Key Points to Understand About Insurer Takebacks:

- Timing and Regulations: Different states have specific regulations governing the timeframe for insurers to request a takeback. For example, in New York, insurers can only recover payments made within the past two years unless there is suspicion of fraud. Additionally, the request must be made within 120 days from the service date for retroactive terminations.

- Information and Verification: When you receive a takeback request, it is crucial to verify the details. The initial communication may often lack sufficient information to identify the patient, date of service, or specific issue. Physicians should request detailed information to perform due diligence and determine the validity of the request.

- Response Time: Typically, providers have 30 days to respond to a takeback request. If no response is made, the insurer may offset the amount against future claims or send the request to a collection agency. Prompt action is essential to avoid these complications.

- Managing Overpayments: If an overpayment is verified, it is advisable to issue a refund rather than allow the insurer to offset the amount against future claims. This approach helps maintain clear records and ensures the overpayment is credited correctly.

- Recovery Companies: Some insurers hire third-party recovery agencies to handle takebacks. Providers are not obligated to communicate with these agencies over the phone. All communications should be conducted in writing, and providers should request evidence of the debt to investigate and respond properly.

- Documentation: It is crucial to keep detailed records of all communications and transactions with insurers. This documentation can support your position if you need to dispute a takeback request or verify compliance with state regulations.

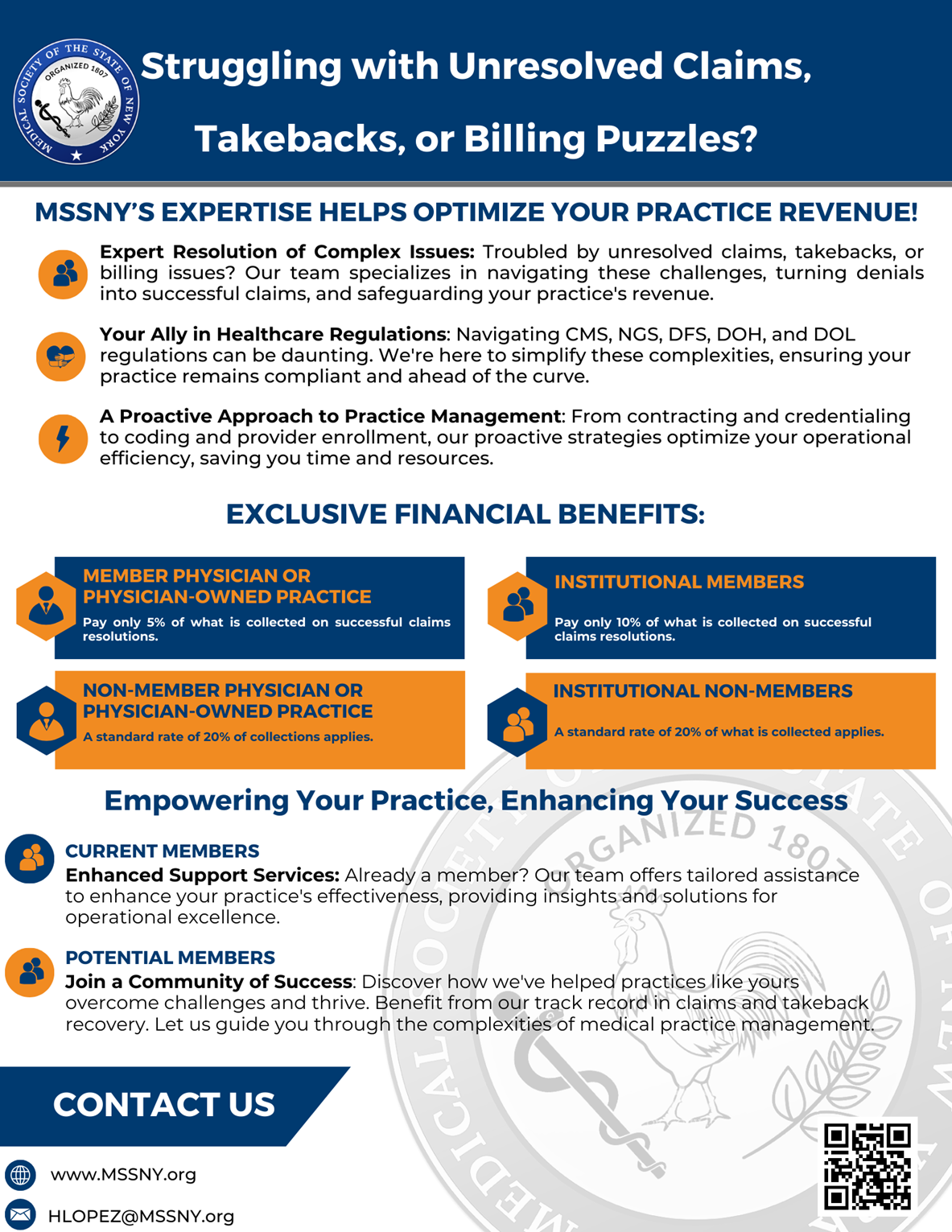

MSSNY’s Division of Physician Payment and Practice is here to help. Over the last two years, the division has dealt with over 1,700 different issues and recouped over $8.5 million from medical insurance providers. Contact Heather Lopez for assistance.